2025 News & Events

March 7, 2025

Minor mobile app & online banking security updates: No action required for most members

We are committed to providing members with a secure and seamless banking experience. As part of ongoing technology improvements, two minor updates will be implemented in March to enhance security, stability, and performance across our mobile app and online banking platform.

On March 11th, the mobile app will be updated to a newer version (17.26.1), reflecting routine security and performance enhancements. Members with automatic app updates enabled will not need to take any action.

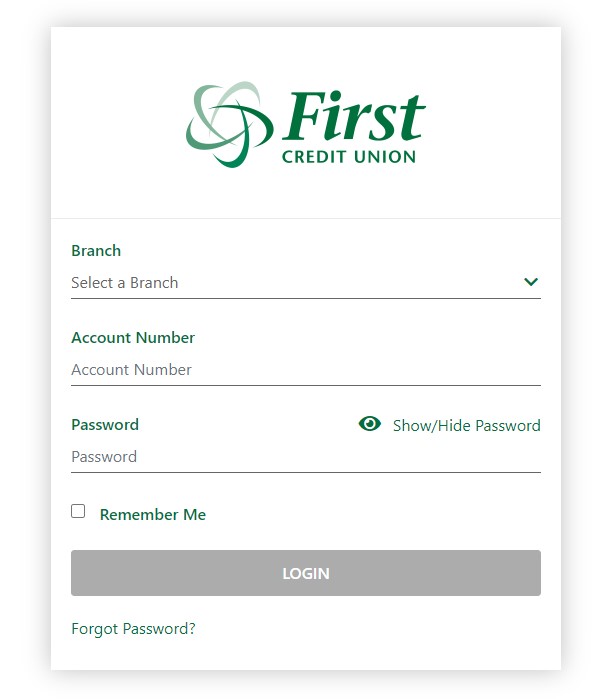

A second update, launching on March 13th, involves a modernization of the authorization server used for online banking logins. While the process behind the scenes will be enhanced, the login experience and appearance will remain unchanged. Members will not lose saved login information as a result of this update.

Have saved bookmarks for online banking? Navigate to firstcu.ca, click the login button, and re-save the updated URL.

These updates are part of our ongoing commitment to security, reliability, and ease of use for our members. While this is a routine enhancement, we encourage members with questions to reach out to their local branch.

March 4, 2025

Annual General Meeting (AGM) postponed until November

The First Credit Union Board of Directors wishes to inform our members that the Annual General Meeting (AGM), originally scheduled to take place in May, has been postponed until November.

This decision was necessary to make way for the oversight associated with the proposed merger with Vancity which was announced on February 27th, 2025. The Annual Report, financial statements, & Governance Report will be posted as usual, however, director elections are also deferred and interested candidates have been notified. We will provide an update on the status of the 2024 AGM in October.

February 27, 2025

First Credit Union & Vancity discuss potential merger

First Credit Union and Vancity are excited to share their intention to explore a potential merger. This merger would strengthen local community banking in British Columbia and enhance member access to financial services in communities on the Upper Sunshine Coast; Vancouver Island; and on Bowen, Texada and Hornby Islands. Read the press release.

February 12, 2025

First Credit Union named one of BC's top 100 employers (for the fourth year in a row!)

We are pleased to announce First Credit Union has been named one of BC’s Top 100 Employers by Mediacorp Canada. Read the press release

January 27, 2025

First Credit Union recognized for excellence by the Comox Valley Chamber of Commerce

We are pleased to announce First Credit Union has been recognized as the 2024 Business of the Year by the Comox Valley Chamber of Commerce at their annual awards gala on January 25, 2025. Read the press release.

January 3, 2025

Call for nominations: Now Open!

Our Board is looking for passionate and community- minded members to join us in achieving that vision by serving as a Director. Nominations close February 3rd at 5:00 PM local time. Learn more & see key dates here.

2024 News & Events

December 2, 2024

'5 Days of Giving' contest

This holiday season from December 2-6, we’re giving YOU the chance to win daily prizes while supporting our community! Visit our social media channels to learn how to enter! Full terms & conditions here.

October 24, 2024

Community Education Series: Plan, retire & leave your legacy with confidence

Join our 'Community Education Series' and let Certified Financial Planner Scott Kovacs, guide you through essential financial decisions at every stage of your journey—from building your retirement plan to leaving a lasting legacy. Choose any (or all) of the options below, email wealth@firstcu.ca or call 1-844-483-8681 to reserve your spot today!

Session #1

Decisions Before Retirement: Essential Financial Choices

With so many options available, understanding your financial choices can feel overwhelming. That’s where our experts come in! Let Scott simplify the process as he walks you through the essential aspects of RRSPs, TFSAs, RESPs, and FHSA accounts, making them easier to understand and tailored to your goals.

Location: Powell River Library, Credit Union Room (100-6975 Alberni St, Powell River, BC V8A 2B8)

Date: Wednesday, November 6, 2024

Time: 7-8PM

Session #2

Navigating Your Retirement: Key Decisions for a Confident Future

As you transition into this exciting new phase, it’s essential to understand the decisions ahead. Join Scott for an insightful discussion covering key topics like sources of retirement income, when to start receiving benefits, pension income splitting, RRSP exit strategies, and capital gains harvesting.

We believe in making your financial journey simpler. Get the clarity you need on when to take your CPP, how to minimize your tax bill, and ways to maximize your retirement income.

Location: First Credit Union Texada Branch (2021 Legion Road, Van Anda, BC V0N 3K0)

Date: Tuesday, November 19, 2024

Time: 2:30-3:30PM

Session #3

Navigating Your Retirement: Key Decisions for a Confident Future

As you transition into this exciting new phase, it’s essential to understand the decisions ahead. Join Scott for an insightful discussion covering key topics like sources of retirement income, when to start receiving benefits, pension income splitting, RRSP exit strategies, and capital gains harvesting.

We believe in making your financial journey simpler. Get the clarity you need on when to take your CPP, how to minimize your tax bill, and ways to maximize your retirement income.

Location: Powell River Library, Credit Union Room (100-6975 Alberni St, Powell River, BC V8A 2B8)

Date: Friday, November 22, 2024

Time: 3-4PM

Session #4

Creating Your Legacy: Financial Planning for What Comes Next

Deciding what to do with your finances after retirement can be challenging. Join us for an insightful discussion where we will guide you through the essential aspects of legacy planning!

Discover the importance of planning ahead and the benefits it can bring. Leaving your financial mark on the people and causes that matter most to you doesn’t have to wait until it’s time to write a will—it can start today. Learn how to leverage the tax system to maximize your giving and support family members now.

Location: Powell River Library, Credit Union Room (100-6975 Alberni St, Powell River, BC V8A 2B8)

Date: Friday, December 6, 2024

Time: 3-4PM

October 21, 2024

Exciting partnership announcement: Wagepoint for small businesses!

We’re thrilled to announce our partnership with Wagepoint, a user-friendly payroll software designed specifically for small businesses. Wagepoint simplifies payroll management by automating essential tasks like wage calculations, tax reporting, and direct payments to employees. As a member, you can enjoy exclusive pricing and dedicated support to make your payroll process even smoother!

Key Benefits:

- Simplified Payroll: Streamline payroll processing with ease.

- Time and Cost Efficiency: Save valuable hours and reduce administrative expenses.

- Dedicated Support: Access expert help to navigate the platform.

This partnership is here to help you focus on what you do best—growing your business! Learn more about Wagepoint here.

August 7, 2024

Union Bay property sale & leaseback

We are pleased to announce a strategic decision to sell the Union Bay branch building while simultaneously leasing back a portion of the property. This move is part of our ongoing commitment to optimize resources and enhance service delivery to our valued members. Read the press release.

July 26, 2024

Do you have a Collabria credit card with us? Access your account online using Cardwise

To access your account online, note that MyCardInfo is officially being replaced with Cardwise. The last day for MyCardInfo is August 19, 2024.

You have 3 ways to access Cardwise:

- Desktop: https://cardwiseonline.ca

- iPhone App

- Android App

Get the mobile apps and learn more: https://www.collabriacreditcards.ca/myaccount.aspx

July 15, 2024

Join us for Movie Under the Stars in qathet!

Join us for a magical evening at Larry Gouthro Park in the qathet Regional District!

Feature Movie: Puss in Boots: The Last Wish

- Date: Thursday, August 15th

- Time: At dusk

- Family-friendly

- Free Admission

Food Trucks

- Rosemary Lane & Co (vegan cuisine)

- Dump Run Provisions (homemade dumplings)

- Convenient Chef (pulled pork and more)

Brought to you by First Credit Union, this event promises fun for the whole family. Bring your blankets, chairs, and snacks, and enjoy a night under the stars with your community.

June 27, 2024

Online Banking: A new login experience launches today

Get answers to your frequently asked questions

June 19, 2024

We’re increasing your account security with 2-step verification

Go live: week of June 24-28

What is it?

2-step verification replaces static security questions with dynamic, one-time verification codes. These codes are generated outside the banking platform and sent to your registered phone or email.

How does it work?

- When prompted, you'll receive a verification code via SMS or email

- Enter the code on the verification page to login to online banking

How does this benefit me?

Enhanced Security: Enjoy an extra layer of protection against fraud.

Note: Members will have a 2-month period to enroll in 2-step verification after its launch.

We’re speeding up your password resets with self-serve reset

Go live: week of June 24-28

We’re thrilled to announce an exciting feature for our for members with personal accounts – Self-Serve Password Reset.

What is it?

This secure, automated solution allows you to easily reset your online banking password without contacting your branch. Using a 2-step verification process, you'll receive a code via your registered phone or email to confirm your identity before setting a new password.

How does it work?

Members must enroll in 2-step verification to activate this feature.

1. Click ‘Forgot Password’ on the online banking login page

2. Follow the instructions and enter the requested information

3. You'll receive a verification code via phone or email

4. Enter the code and set your new password.

How does this benefit me?

Faster Service: No need to visit a branch or call the contact center

Mobile Access: Reset your password on the go or from home.

June 6, 2024

Annual General MeetingCommunity Impact Day: Closing early makes a big difference

On Thursday, June 20 (Wednesday, June 19 on Hornby Island) First Credit Union branches will close at 1PM as more than one hundred employees head out into their communities to volunteer. Read the press release.

April 19, 2024

Annual General Meeting

Learn about our upcoming AGM, election & special resolution. Learn more and register here.

March 15, 2024

HSBC disconnecting from THE EXCHANGE Network

HSBC is disconnecting from THE EXCHANGE Network, used by credit unions on March 18, 2024. If you rely on HSBC ATMs, find a Ding Free ATM near you.

February 15, 2024

Impact donations open until March 15th

Impact donations help us empower social & environmental impact initiatives in the communities we serve. Intakes are in held biannually in February and August, both FCU members and non-members can apply, though preference is given to members.

Donations are given to projects/initiatives/organizations that align with our focus areas of diversity, equity/inclusion, environmental sustainability, and local economic development. Preference is given to applications that meet immediate community needs and/or that foster systemic change. Read more & apply here.

February 13, 2024

First Credit Union named as one of BC's Top Employers for the third consecutive year!

Being acknowledged as a Top Employer in BC is a testament to the hard work and dedication of First Credit Union employees, who are the building blocks of the organization and who continue to work toward the vision of building financially healthy communities. Read the press release.

January 15, 2024

Upcoming serivce disruptions - ATM updates

Please be advised that our ATMs will be temporarily unavailable while updates take place, see service dates below. We apologize for any inconvenience this may cause. Please consider visiting one of our other branches or using online banking/mobile banking during these updates.

Thank you for your understanding as we work to enhance our services.

Courtenay branch - Thursday, March 7

Powell River branch - Thursday, March 14

Bowser branch - Thursday, February 15

Union Bay branch - Wednesday, March 13

Hornby Island branch - Wednesday, February 21

January 5, 2024

Temporary Closure: Cumberland branch

Please be advised that our Cumberland branch is temporarily closed due to an unfortunate incident earlier this morning. The branch was subject to a break-in, resulting in significant damage to the building.

For the safety of our members and employees, the Cumberland branch will remain closed during the police investigation and until the necessary repairs and cleanup are completed. We assure you that we are working diligently to resolve the situation and restore normal operations as quickly as possible.

During this temporary closure, we encourage our members to utilize our online banking services, ATMs, and other branch locations. Our dedicated member service team can assist you remotely with inquiries or transactions.

We will provide regular updates on the status of the Cumberland branch through our website and social media channels. If you have any immediate concerns or require assistance, please get in touch with our contact centre at membersupport@firstcu.ca or 1-800-393-6733.

We sincerely apologize for any inconvenience this temporary closure may cause and appreciate your ongoing support as we navigate this challenging situation. Thank you for your patience and understanding.

2023 News & Events

December 7, 2023

Enhanced Interac e-Transfer® for business coming in January 2024

To further elevate member experience, First Credit Union is excited to announce the launch of the initial phase of Interac e-Transfer® for Business in January 2024. This enhancement to the existing Interac e-Transfer® service enables the receipt of real-time, account number routed, and data-rich transactions, providing First Credit Union members with cutting-edge digital payment capabilities.

Key Features of the Enhanced Interac e-Transfer® for Business:

- Receive payments in real-time with immediate confirmation to gain faster access to your funds and better manage liquidity.

- Receive e-Transfers using your account number instead of your email or phone number so funds can be deposited straight into your bank account.

- Receive data-rich remittance information (like invoice details) to manage payments with greater efficiency and control.

Canadian businesses are actively seeking more efficient and secure payment methods. By launching the first phase of Interac e-Transfer for Business, First Credit Union ensures members have access to advanced payment solutions, reducing the time-consuming process of receiving and reconciling cheque payments and enhancing efficiency in managing receivables and cash flow. Learn more about what Interac e-Transfer can do for your business.

September 15, 2023

Changes to paper statements

As part of our ongoing commitment to sustainability and operational efficiency, we will be implementing a nominal fee for paper statements.

Starting November 1, 2023, we will be introducing a $2 fee for paper statements for members who choose this service*. This decision aligns with our efforts to reduce paper usage and promote eco-friendly practices, while also helping us allocate resources more effectively to better serve your needs.

If you are currently receiving paper statements, we encourage you to consider switching to electronic statements, which are free, convenient, readily accessible through online banking, and more environmentally friendly.

Benefits of e-statements:

- Convenience: e-statements are received faster than paper statements, and are available 24/7. You can easily review statements up to 7 years old.

- Security: e-statements are more secure than paper statements. They are encrypted & password-protected so your personal and financial information is kept safe.

- Eco-friendly: e-statements reduce paper waste, helping to conserve our planet's natural resources. By switching to e-statements, you can help reduce your carbon footprint and support sustainability

To transition to electronic statements, please follow these simple steps:

- Log in to your First Credit Union account on our website.

- Navigate to the "Account Settings" and “Statement Preferences” section.

- Choose the option for “e-statements only” and verify/update your email address.

If you are not currently set up for online banking and wish to do so, please call or visit your local branch so that we can support you. If you have any concerns or require assistance with this transition, our member support team is here to help.

Thank you for your understanding and support as we work towards a more sustainable future.

*Please note that student and estate accounts are exempt from this fee

September 14, 2023

ATM Replacements: Service disruption notice

In our commitment to providing you with the best banking experience, we are replacing our ATMs at certain locations.

Please take note of the following replacement schedule:

- Bowser Branch: September 26th

- Union Bay Branch: September 27th

- Hornby Island Branch: September 28th

On these dates, the ATM at the respective branch will be temporarily out of service from 8 AM to 5 PM. We apologize for any inconvenience and recommend using the ATMs available at our other branch locations or visiting any of our branches during regular business hours (see branch locations and hours). We also encourage you to take advantage of the Deposit Anywhere feature on our mobile app.

Thank you for your understanding as we work to enhance our services. If you have any questions or need assistance during this period, please do not hesitate to contact your local branch.

September 1, 2023

Service interruption: Scheduled maintenance for online & voice banking

Please be advised that an upcoming scheduled maintenance will temporarily affect our online banking and voice banking services. Please take note of the following details:

Maintenance Date and Time: September 10th, starting at 11:00 AM

Estimated Duration: 1 - 2 hours

During this maintenance window, both our online banking and voice banking services will be temporarily unavailable. We understand the importance of these services to our members and want to assure you that our dedicated teams will be working diligently to complete the maintenance as quickly as possible.

What to Expect:

• Online banking access will be temporarily disabled.

• Voice banking services will be unavailable during this time.

• Any attempts to access these services might result in error messages.

Alternate Options: While the online and voice banking services are temporarily unavailable, you can still perform various banking tasks through our ATMs. Your debit cards will continue to work during this period.

We sincerely appreciate your patience and understanding as we work to enhance and improve our services. Our goal is to provide you with the best banking experience possible, and this maintenance is a step toward achieving that.

August 24, 2023

Remembering the Legacy of Former CEO Dave Craigen: A Visionary Leader and Friend

It is with profound sorrow that we announce the passing of our former CEO, Dave Craigen. Dave passed away on August 10, 2023. The entire First Credit Union family is united in mourning the loss of a visionary leader and cherished friend. Dave’s leadership and dedication were pivotal in driving First Credit Union’s success. He was not only a remarkable leader but also a respected mentor and friend to many within the company,” says Guy Chartier, Board Chair of First Credit Union. Read the press release.

July 7, 2023

Union Bay & Bowser branch ATM deposits

Effective July 26, the ATMs located at our Union Bay and Bowser branch locations will temporarily be unable to accept deposits. We are preparing to install new ATMs in these locations before September 30 and once the installation is complete, these ATMs will resume accepting deposits.

Members are able to utilize the ATMs available at our Cumberland or Courtney branch locations, or visit any of our branches during regular business hours (please refer to the hours below). We also encourage you to take advantage of the Deposit Anywhere feature on our mobile app.

We sincerely appreciate your patience and understanding during this transition. We apologize for any inconvenience this may cause, and we are committed to providing you with the best possible banking services. Thank you for your continued support.

See branch hours here.

June 6, 2023

Challenges with debit card tap function

Please be aware that we are currently experiencing issues with the tap function on some debit cards at select merchant locations. This issue is currently being investigated by our third party vendor, who is working diligently to fix this problem as soon as possible. If you are experiencing problems with your tap function, you can still transact using the chip function on the card. Please note that replacing your card will NOT resolve this issue. We apologize for the inconvenience and thank you for your patience.

June 1, 2023

Community Impact Day: Closing Early Makes a Big Difference

On Thursday, June 15 First Credit Union branches around Vancouver Island and the Sunshine Coast will close at 2pm as more than one hundred employees head out into their communities to volunteer at beach cleanups, community gardens, a seniors’ residence and more. Read the press release.

May 2, 2023

Debit card update deadline has been extended

If you have recently received a letter alerting you that your debit card needs to be updated by July 31, 2023. Please be advised that the deadline to replace your debit card has been extended to December 31, 2023. *If you did not receive this letter please ignore this message. Thank you.

April 19, 2023

Android app users: Important update coming May 1, 2023

For our mobile app users on Android phones, you can expect a new version of the app available on May 1, 2023. The new version will become a required update after May 10, 2023. Visit the Google App Store after May 1 for more information on this important update.

April 14, 2023

Register to join our Annual General Meeting on May 9th, 2023 @ 5pm

Hear from our Board of Directors and learn more about the credit union’s performance and activities over the past year. Join fellow members and employees as we reflect on the growth and achievements of 2022.

March 7, 2023

Collabria adds new layer of security to online transactions

A new added layer of security to online transactions will be implemented with One Time Passcode. The launch of the fraud protection measure will begin on March 7th, 2023.

What is a One Time Passcode? A one-time passcode (OTP) is a secure authorization method where a numeric code is sent to a mobile number. A passcode request will pop up during online transactions when the system detects the need for additional security. If a cardholder receives a request, they will need to check their mobile phone for a text containing the passcode, then enter it where prompted online. If cardholders do not enter the correct passcode, their transaction will not go through. Cardholders will then need to contact Cardholder Services directly at 1.855.341.4643 to resolve.

Who will receive One Time Passcodes?

One-time passcodes will not apply to most transactions. This extra authentication step is a sign that security measures are working to keep your account safe.

As a reminder, Collabria will not contact cardholders asking for them to share the OTP over the phone, by text or by email. Collabria also will not ask cardholders to click on any links or share personal information such as credit card account numbers, social insurance numbers, etc.

February 14, 2023

First Credit Union recognized as one of 'BC's Top Employers' for the second year in a row!

Now in its 18th year, BC’s Top Employers recognizes employers that lead their industries in offering exceptional places to work. We are honored and grateful to receive this recognition and continue efforts to foster a healthy, vibrant and engaged workforce. Read the press release here.

To learn more about this designation click here.

January 4, 2023

Call for Nominations: Join our Board of Directors & be a force for good!

Use your skills, knowledge and abilities to help set the strategic direction of First Credit Union. Applications to join our Board of Directors is open until February 6, 2023. To learn more about the application process visit our elections page.

2022 News & Events

November 10, 2022

Telephone banking will retire on January 31, 2023

As members continue a shift towards using First Credit Union’s online banking and mobile app, our telephone banking system is not utilized as much, and our technology is becoming outdated and harder to maintain. As such, we will be retiring telephone banking on January 31, 2023. If you are still using telephone banking, we invite you to explore alternative ways to do your banking remotely, including our online banking and mobile app. We also encourage you to contact your local branch to discuss your banking options.

October 20, 2022

Members receive over $390,000 in profit share

On Thursday, October 20, First Credit Union members were paid a profit share rebate based on service charges, loan interest and deposit interest for 2021, amounting to over $390,000. Moving forward, these profits will be redirected to enhance member benefits, making 2022 the final year for profit share.

As a financial cooperative, First Credit Union distributes profits by investing in community and members. After reviewing our profit share program and considering member feedback, we believe that members will see a more significant impact if the allocated funds are applied to enhancing member benefits as opposed to returning nominal rebates. One of the recent enhancements has been free e-transfers for all members – a benefit that was introduced on July 1, 2022.

Please reach out to your branch with any questions you may have.

August 22, 2022

Upcoming Union Bay & First Credit Union banking system integration

As part of our merger with Union Bay Credit Union, on September 9th we will be integrating the Union Bay Credit Union banking system with the First Credit Union banking system. We have created an online Integration Resource Centre to find out what this will mean for you. Click here to visit the banking system integration centre.

Thank you for your patience & understanding.

August 4, 2022

Mobile app upgrade

Due to routine app development and improvements you may be forced to update/reinstall your First Credit Union banking app on your mobile device. If you require any assistance please contact your local branch. The app is available to download for iOS via the Apple App Store and for Android via the Google Play store.

July 11, 2022

Annual member statements

For those members that only receive an annual statement, you will be receiving your statement in the third quarter this year. This allows us to complete the banking system integration of First Credit Union and legacy Union Bay Credit Union, and pay profit share to all members. This will be reflected on your statement.

After reviewing the profit share program and considering member feedback, 2022 will be the final year for the profit share rebate. This final rebate will be paid to all members in the fall of 2022. While we typically pay member profit share in June, this will allow time for the integration. Please reach out to your branch with any questions you may have.

June 22, 2022

FREE e-transfers as of July 1st!

Sending and receiving money by e-transfer is fast, safe, and as of July 1st FREE for all members! This is a limited time offer for business accounts valid until April 30th 2023.

May 30, 2022

Upcoming changes to profit share

In 2022, we will change how we share profits with members. Currently, profits are shared through various means, including community investment, scholarships, enhancements to member products and services, and profit share rebates. After reviewing the profit share program and considering member feedback, we believe that the money currently allocated to returning nominal rebates to qualifying members could have a more significant impact if applied to enhancing member benefits. With that in mind, 2022 will be the final year for the profit share rebate.

This final rebate will be paid to all members in the fall of 2022. While we typically pay member profit share in June, delaying payment will allow time for the integration of First Credit Union and legacy Union Bay Credit Union banking systems, which is necessary for all members to receive payment. Please reach out to your branch with any questions you may have, and we encourage you to watch for enhanced service benefits as early as July 1st.

May 18, 2022

Coming soon - New branch hours!

As of July 4th, there will be new operating hours at some First Credit Union branches. Changes include increased access to branch services at our Vancouver Island locations with more branches open Monday to Friday. See below for all branch hours as of July 4th.

|

|

Monday |

Tuesday |

Wednesday |

Thursday |

Friday |

Saturday |

|

Powell River |

9:30 - 4:30 |

9:30 - 4:30 |

9:30 - 4:30 |

9:30 - 4:30 |

9:30 - 4:30 |

CLOSED |

|

Courtenay |

9:30 - 4:30 |

9:30 - 4:30 |

9:30 - 4:30 |

9:30 - 4:30 |

9:30 - 4:30 |

CLOSED |

|

Cumberland |

CLOSED |

9:30 - 4:30 |

9:30 - 4:30 |

9:30 - 4:30 |

9:30 - 4:30 |

9:00 - 1:00 |

|

Union Bay |

9:30 - 4:30 |

9:30 - 4:30 |

9:30 - 4:30 |

9:30 - 4:30 |

9:30 - 4:30 |

CLOSED |

|

Bowser |

CLOSED |

9:30 - 4:30 |

9:30 - 4:30 |

9:30 - 4:30 |

9:30 - 4:30 |

9:00 - 1:00 |

|

Hornby |

CLOSED |

9:30 - 3:00 |

9:30 - 3:00 |

CLOSED |

9:30 - 4:00 |

CLOSED |

|

Texada |

10:00 - 5:00 |

10:00 - 5:00 |

10:00 - 5:00 |

10:00 - 5:00 |

10:00 - 5:00 |

CLOSED |

|

Bowen |

10:00 - 5:00 |

10:00 - 5:00 |

10:00 - 5:00 |

10:00 - 5:00 |

10:00 - 5:00 |

CLOSED |

How to bank with First Credit Union outside of branch hours:

You can access your accounts anywhere, anytime. Pay bills, deposit cheques, send or receive money (even internationally), and more. Contact us to register for online banking and know that our safe, digital banking system has you covered...wherever you are!

May 13, 2022

Co-operators' office in Cumberland (currently located next to our Cumberland branch) moving to 8th Street

Effective May 30th, the Co-operators' office in Cumberland (currently located next to the First Credit Union Cumberland branch) will be moving to their 8th Street Courtenay office. We will miss having our insurance colleagues right next door, and wish them all the best in their new location. If you have any questions, please reach out to the Cooperators at (250) 334-3443 or courtenay_8th@cooperators.ca

April 5, 2022

Let's Talk Trash & First Credit Union awarded a $5,000 grant to develop educational signage at the qathet Regional District's Resource Recovery Centre

We are excited to announce that on Tuesday, April 5, Wyth Financial awarded a $5,000 grant to Let's Talk Trash and First Credit Union to develop educational signage at the qathet Regional District’s Resource Recovery Centre through Wyth's “Empowering Your Community” annual grant program. Read the press release here.

February 8, 2022

First Credit Union Named one of BC's Top Employers

We are proud to announce that we have been named one of BC’s Top Employers for 2022!

This award recognizes exceptional employers/workplaces that lead in their industries and celebrates our ongoing efforts to foster a healthy, vibrant and engaged workforce.

While being honored as a Top Employer in BC recognizes our focus on overall employee wellbeing, we believe it is our employees and their commitment to our members and the communities we serve that make First Credit Union an incredible place to work. Read the press release here.

To learn more about this designation click here.

2021 News & Events

December 17, 2021

Family Insurance/Economical Insurance

If you have ever had a policy with Family Insurance, you may have recently received an email or package in the mail from their parent company, Economical Insurance. For further information, please visit the Economical Insurance website. You can also find answers to Frequently Asked Questions here.

October 22, 2021

Small Business Online Banking

On Wednesday November 3rd, a banking system update will take place which will impact the login requirements for all secondary signers on small business banking accounts. Currently signers share the same login ID (account number), and have their own unique password. After the scheduled update, each signer will have their own login ID. The major benefit of this change, is that if one signer gets locked out of online banking, it will not affect the other signers access. Our member service team is reaching out to all members affected by this change. In the meantime, if you have any questions please reach out to your local branch.

October 19, 2021

Debit card tap (flash) limit increase

As per Interac’s requirement to increase debit card tap (flash) limits to $250, First Credit Union will begin updating debit card limits in 2022. Please contact your local branch with any questions.

September 8, 2021

Union Bay Collabria credit card transition

With the merger of Union Bay Credit Union and First Credit Union, and the subsequent transition of products and services, members who currently have a Union Bay Collabria* credit card will be sent a replacement First Credit Union Collabria credit card in the mail. Your new card will have the same features and terms and conditions as your existing Union Bay Collabria credit card. Your credit limit will remain the same. All outstanding balances and rewards points will be transferred to your new credit card on September 29, 2021, if applicable.

Important Information for you to know

1. You will be receiving a letter in the mail from Collabria, with details about this transition. Your new First Credit Union credit card will arrive shortly thereafter.

2. Historical e-statements for your Union Bay Credit Union credit card will not be transferred to your new First Credit Union credit card account in MyCardInfo. Should you need a record, please download them with your existing Union Bay Credit Union MyCardInfo access before you activate your new card.

3. Enroll your new First Credit Union credit card in MyCardInfo.com to manage your account online 24/7 and signup for e-Statements. If you don’t sign up for e-Statements, you will be sent paper statements to the address Collabria has on file.

Next steps to ensure a smooth transition

1. Please activate your new First Credit Union credit card as soon as you receive it. You will no longer be able to use your Union Bay credit card upon activation of your new First Credit Union credit card. existing card PIN will be transferred to your new card when activated.

2. Your Union Bay credit card account will be closed on October 29th after which you will no longer be able to use your existing card.

3. Enroll your new First Credit Union credit card in MyCardInfo.com to manage your account online 24/7 and signup for e-Statements.

4. If you have set up any automated recurring bill payments on your Union Bay Credit Union credit card, please remember to update your payment information with your new First Credit Union credit card number as soon as you receive and activate your new card, since your credit card number is changing.

We thank you for your continued trust and support of your First Credit Union credit card program. For any further inquiries, please call Collabria Cardholder Services at 1-855-341-4643.

*Disclaimer The Collabria Card is issued by Collabria Financial Services Inc. pursuant to a license. All other trademarks are the property of their respective owner(s).

September 1, 2021

First Credit Union to close on National Day for Truth & Reconciliation

First Credit Union is choosing to honour this day as part of our ongoing commitment toward truth and reconciliation. More information here.

September 1, 2021

COVID-19 Update

As we navigate through the 4th wave of the pandemic, First Credit Union will continue to operate in a way that keeps our employees, members and communities safe, adheres to the provincial mandates that we are required to follow, and aligns with our values to be inclusive and respects people’s privacy and diversity of opinions.

Member and employee safety is our priority, and therefore First Credit Union encourages members to bank remotely when possible. For branch visits face masks are required, and plexi-glass shields remain at teller wickets and spaces where people must stand or sit in close proximity to one another. This is a challenging time for everyone. We appreciate the patience, kindness and understanding that our members have demonstrated as we work together through uncharted territory.

July 1, 2021

We have merged with Union Bay Credit Union

We're growing! We have merged with Union Bay Credit Union. As a member you now have access to 8 branch locations to serve you better. Union Bay Credit Union members will continue banking as usual, while the further integration of both credit unions continues into 2022. More information here.

June 9, 2021

First Credit Union members receive $380,000 in profit share

On Wednesday, June 9, in coordination with our 82nd anniversary, all members received a profit share rebate based on service charges, loan interest and deposit interest paid in 2020, which amounts to $380,000.

We are the longest-running credit union in BC, incorporated in 1939. With five credit union branches, over $580 million in credit union and $160 million in wealth management assets, we serve over 12,000 members in five coastal communities. More information here!

June 1, 2021

Our member scholarships are open for applications!

Applications are open June 1st - July 30th. Details & online application form here. We are committed to celebrating diversity and building equity. We welcome scholarship applications from all of our members, including visible minorities, Indigenous Peoples, persons with disabilities, persons of diverse sexual orientation, gender identity or expression (LGBTQ2S+) & others who may contribute to diversity in the communities we serve. We also encourage members or their allies to reach out to us should they need assistance with the application. Apply today!

May 15, 2021

Union Bay Credit Union members vote strongly in favour of a merger with First Credit Union

Members of Union Bay Credit Union have approved a merger with First Credit Union. Operating as First Credit Union, the merged entity will have over $600 million in assets and serve a combined membership of more than 15,500. More information here.

March 17, 2021

COVID-19: Updates & member safety

To support our members to do their banking remotely, First Credit Union waived all e-transfer fees for members from March 19, 2020 to March 31, 2021. All fees will return to normal as of April 1, 2021.

To help reduce the spread of COVID-19 we are encouraging our members to do less in our physical branches and to take advantage of our mobile, online & telephone banking. We are here to help you. If you would like to talk to someone, please call your local branch or our toll free line at 1-800-393-6733. Read the latest update from our CEO here.

Remember it's important to stay diligent. Cybercriminals have been using the COVID-19 pandemic to launch phishing attacks and various other scams. Watch out for associated scams. Find out more about fraud protection here.

Member Financial Relief

To support our members to do their banking remotely, First Credit Union waived all e-transfer fees for members from March 19, 2020 to March 31, 2021. All fees will return to normal as of April 1, 2021.

Our Payment Deferral Program is designed to support members and help you focus on what matters most—your health and your family. If you think you’ll be unable to make an upcoming loan/mortgage payment, please reach out to your local branch before you miss the payment. We’ll discuss your options and come up with a plan that works for your financial situation.

For members with a Collabria credit card, Collabria has financial supports in place. Visit Collabria's website for more information.